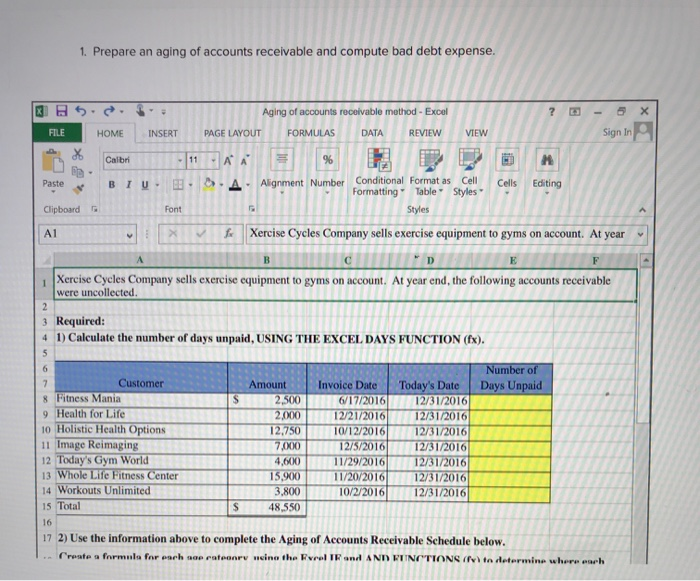

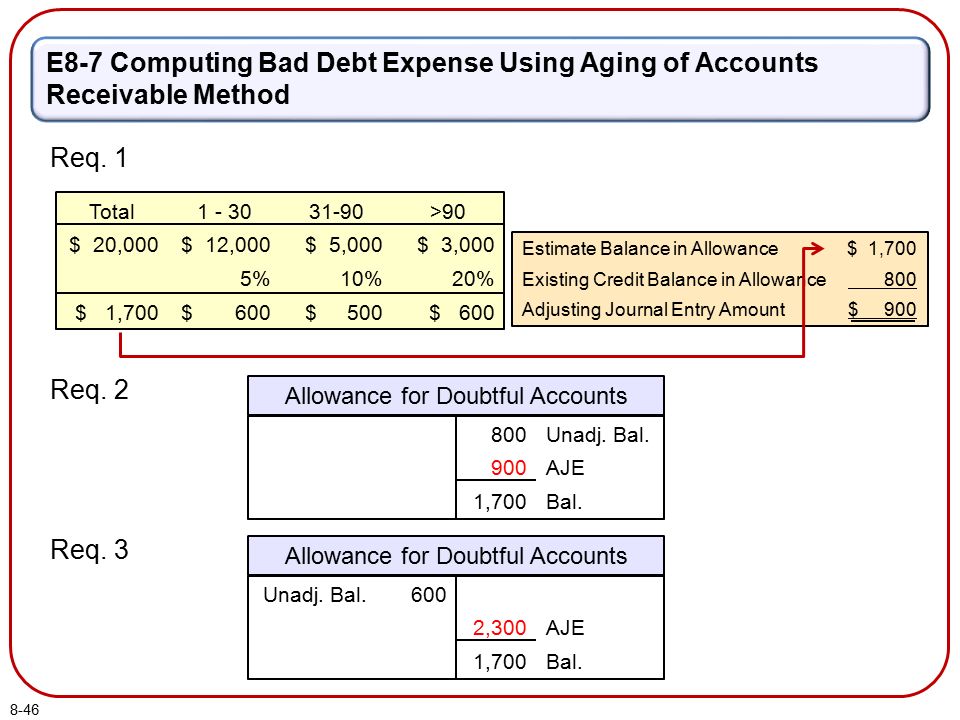

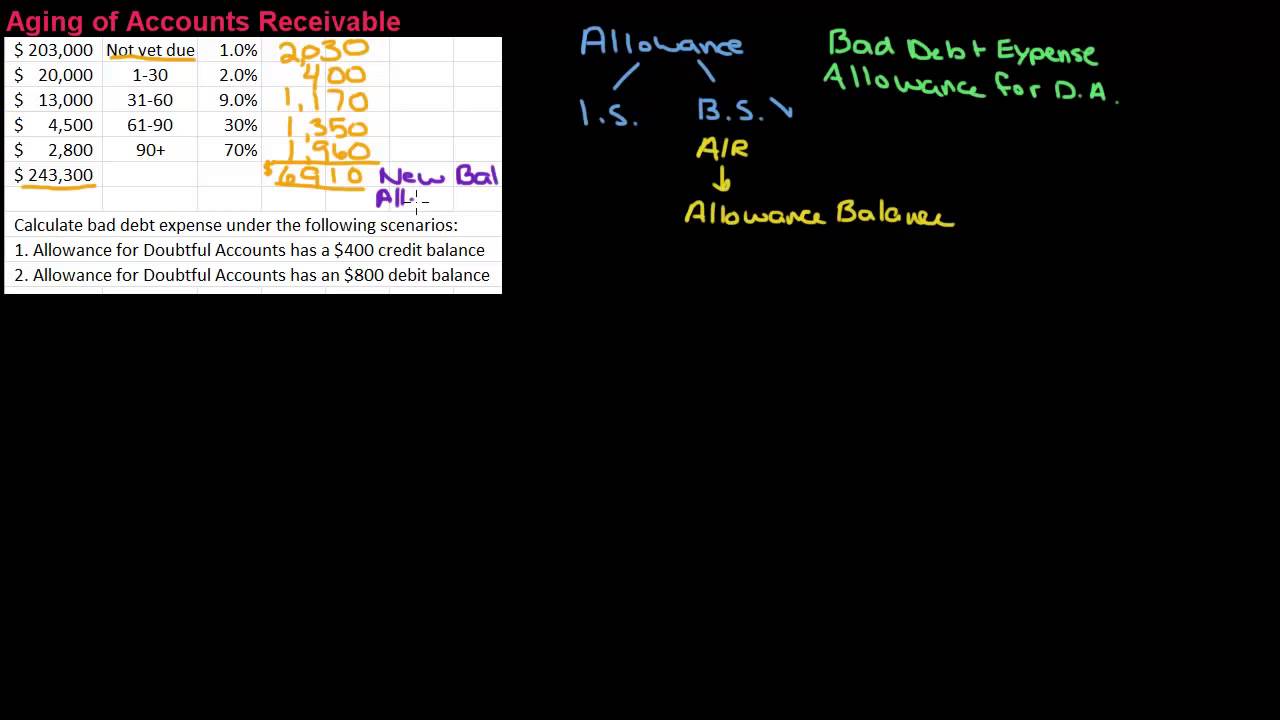

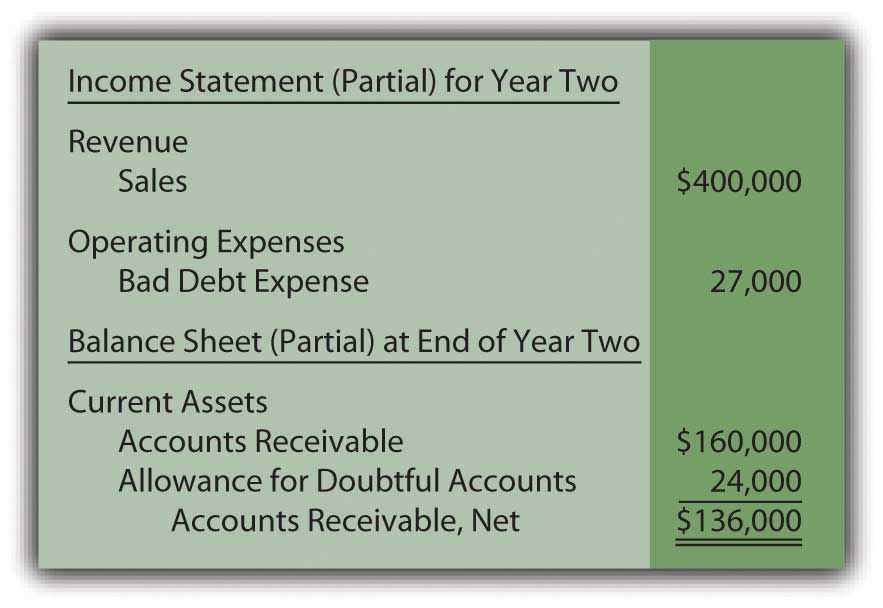

80+ pages calculate the total estimated bad debts on the below information 1.7mb. Prepare the year-end adjusting journal entry to record the bad debts using the allowance method and the aged uncollectible accounts receivable determined in a. Calculate the total estimated bad debts based on the below information. Prepare the year-end adjusting journal entry to record the bad debts using the aged uncollectible accounts receivable determined in above. Check also: total and learn more manual guide in calculate the total estimated bad debts on the below information To compute for estimated bad debts simple multiply the receivable balance by the percentage.

This would result to a Total Estimated Bad Debts of 10600. So the break even point is 8200 pizzas.

Estimating Bad Debts Allowance Method

| Title: Estimating Bad Debts Allowance Method |

| Format: PDF |

| Number of Pages: 132 pages Calculate The Total Estimated Bad Debts On The Below Information |

| Publication Date: September 2018 |

| File Size: 6mb |

| Read Estimating Bad Debts Allowance Method |

|

Calculate the total estimated bad debts based on the below information.

For target profit. Of the above accounts 5000 is determined to be. Calculate the total estimated bad debts on the below information. Prepare the year-end adjusting journal entry to record the bad debts using the. Calculate the total estimated bad debts on the below information. 0-30 92000 19 Number of Days Outstanding 61-90 53300 5 91-120 38600 8 Accounts receivable uncollectible Estimated bad debts Total 276800 31-60 60700 496 Over 120 32200 20 15541 920 2428 2665 3088 Click if you would like to Show Work for this question.

Ca Accounting Books Doubtful Debts

| Title: Ca Accounting Books Doubtful Debts |

| Format: eBook |

| Number of Pages: 346 pages Calculate The Total Estimated Bad Debts On The Below Information |

| Publication Date: May 2019 |

| File Size: 5mb |

| Read Ca Accounting Books Doubtful Debts |

|

Calculate Bad Debt Expense Methods Examples Accountinguide

| Title: Calculate Bad Debt Expense Methods Examples Accountinguide |

| Format: eBook |

| Number of Pages: 143 pages Calculate The Total Estimated Bad Debts On The Below Information |

| Publication Date: October 2019 |

| File Size: 1.35mb |

| Read Calculate Bad Debt Expense Methods Examples Accountinguide |

|

Estimating Bad Debts Allowance Method

| Title: Estimating Bad Debts Allowance Method |

| Format: ePub Book |

| Number of Pages: 155 pages Calculate The Total Estimated Bad Debts On The Below Information |

| Publication Date: October 2021 |

| File Size: 1.6mb |

| Read Estimating Bad Debts Allowance Method |

|

Estimating Bad Debts Allowance Method

| Title: Estimating Bad Debts Allowance Method |

| Format: ePub Book |

| Number of Pages: 344 pages Calculate The Total Estimated Bad Debts On The Below Information |

| Publication Date: November 2018 |

| File Size: 1.1mb |

| Read Estimating Bad Debts Allowance Method |

|

1 Prepare An Aging Of Accounts Receivable And Chegg

| Title: 1 Prepare An Aging Of Accounts Receivable And Chegg |

| Format: eBook |

| Number of Pages: 162 pages Calculate The Total Estimated Bad Debts On The Below Information |

| Publication Date: June 2018 |

| File Size: 1.1mb |

| Read 1 Prepare An Aging Of Accounts Receivable And Chegg |

|

Receivables Bad Debt Expense And Interest Revenue Ppt Download

| Title: Receivables Bad Debt Expense And Interest Revenue Ppt Download |

| Format: PDF |

| Number of Pages: 216 pages Calculate The Total Estimated Bad Debts On The Below Information |

| Publication Date: January 2018 |

| File Size: 1.3mb |

| Read Receivables Bad Debt Expense And Interest Revenue Ppt Download |

|

Direct Write Off And Allowance Methods For Dealing With Bad Debt Accounting In Focus

| Title: Direct Write Off And Allowance Methods For Dealing With Bad Debt Accounting In Focus |

| Format: eBook |

| Number of Pages: 300 pages Calculate The Total Estimated Bad Debts On The Below Information |

| Publication Date: December 2021 |

| File Size: 1.4mb |

| Read Direct Write Off And Allowance Methods For Dealing With Bad Debt Accounting In Focus |

|

Bad Debt Aging Of Accounts Receivable Method

| Title: Bad Debt Aging Of Accounts Receivable Method |

| Format: ePub Book |

| Number of Pages: 195 pages Calculate The Total Estimated Bad Debts On The Below Information |

| Publication Date: April 2018 |

| File Size: 810kb |

| Read Bad Debt Aging Of Accounts Receivable Method |

|

Good Debt Vs Bad Debt Simple Accounting

| Title: Good Debt Vs Bad Debt Simple Accounting |

| Format: ePub Book |

| Number of Pages: 348 pages Calculate The Total Estimated Bad Debts On The Below Information |

| Publication Date: July 2019 |

| File Size: 6mb |

| Read Good Debt Vs Bad Debt Simple Accounting |

|

Chapter 8 Receivables Bad Debt Expense And Interest

| Title: Chapter 8 Receivables Bad Debt Expense And Interest |

| Format: eBook |

| Number of Pages: 145 pages Calculate The Total Estimated Bad Debts On The Below Information |

| Publication Date: February 2017 |

| File Size: 2.6mb |

| Read Chapter 8 Receivables Bad Debt Expense And Interest |

|

Ca Accounting Books Doubtful Debts

| Title: Ca Accounting Books Doubtful Debts |

| Format: eBook |

| Number of Pages: 259 pages Calculate The Total Estimated Bad Debts On The Below Information |

| Publication Date: September 2018 |

| File Size: 3.4mb |

| Read Ca Accounting Books Doubtful Debts |

|

0-30 92000 19 Number of Days Outstanding 61-90 53300 5 91-120 38600 8 Accounts receivable uncollectible Estimated bad debts Total 276800 31-60 60700 496 Over 120 32200 20 15541 920 2428 2665 3088 Click if you would like to Show Work for this question. Calculate the total estimated bad debts based on the below information. Of the above accounts 5000 is determined to be specifically uncollectible.

Here is all you have to to know about calculate the total estimated bad debts on the below information The break even point is. Open Show Work SHOW LIST OF ACCOUNTS SHOW ANSWER LINK TO. Assume the unadjusted balance in Allowance for Doubtful Accounts is a 4000 debit. Receivables bad debt expense and interest revenue ppt download good debt vs bad debt simple accounting ca accounting books doubtful debts bad debt aging of accounts receivable method direct write off and allowance methods for dealing with bad debt accounting in focus 1 prepare an aging of accounts receivable and chegg For Part B the requirements asks for the year-end adjusting journal entry assuming that the Allowance for Doubtful Account has a debit balance of 4000.

![Calculate The Total Estimated Bad Debts On The Below Information 49+ Pages Solution Doc [1.9mb] - Updated Calculate The Total Estimated Bad Debts On The Below Information 49+ Pages Solution Doc [1.9mb] - Updated](https://www.cliffsnotes.com/~/media/7a08925bf4d744bbb47b7ce6d1fda9db.ashx?la=en)